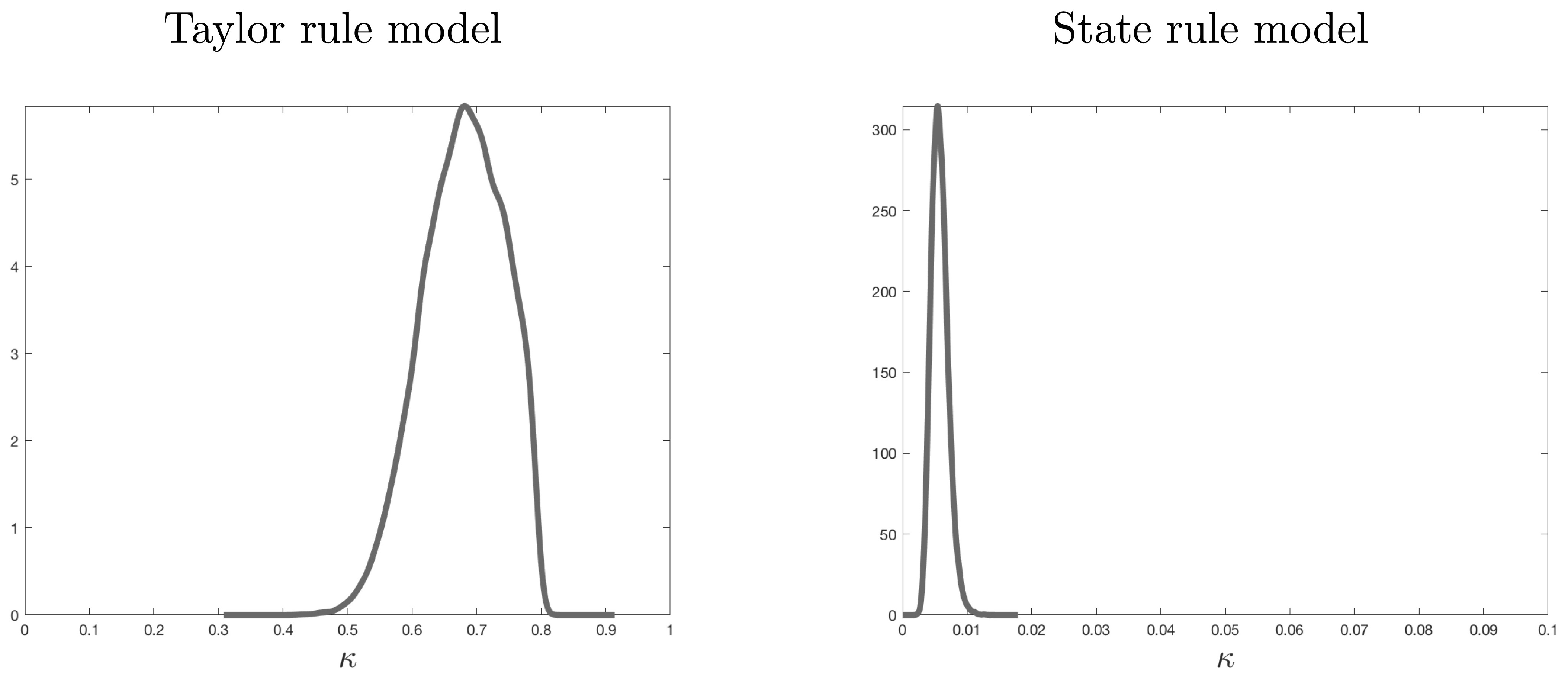

I gave a seminar in Norwich Thursday 15 Feb. and presented a new project with Paul Beaudry and Sev Hou, “The Dominant Role of Expectations and Broad-Based Supply Shocks in Driving Inflation”.

First draft not yet ready. As written in the abstract,

In light of the experience of the last few years, the object of this paper is to re-examine the role of supply shocks, labour market tightness and expectation formation in explaining bouts of inflation. We begin by showing that a quasi-flat Phillips curve, which was popular prior to the pandemic, still fits the post-2020 US data well with the implication that (i) labour market tightness likely played a limited role in generating recent inflation and (ii) changes in short term inflation expectations induced by supply shocks likely played a major role. We then explore how best to capture the joint dynamics of inflation and inflation expectations in response to supply shocks. Given the difficulty of capturing these dynamics under rational expectations, we propose and evaluate a model with bounded rationality. In our model, supply shocks that affect the common component of inflation across many goods drive persistent inflation dynamics through their effect of expectations, while supply shocks that are concentrated in a sector lead to much more temporary changes in both inflation and inflation expectations. Although our departure from full rationality is minor, it allows perceived broad-based supply shocks to be amplified and propagated over time in a manner consistent with observation.

Thanks to Ariel Gu ad Martin Bruns for the invitation.

I have posted on my “

I have posted on my “

I posted on my “

I posted on my “